As we as a business reflected on the different trends we felt were worth talking about for 2022, the fintech investment scene and current tech stocks felt like something worth expanding on more widely.

Before we focus on the current climate let's talk very briefly about the drivers of the dot com bubble:

Low interest rates, huge amounts of capital pumped into fledgling businesses in the hope of turning a profit and a volatile tech stock market - Sound familiar?

Whilst it could be a slightly lazy comparison there are certainly parallels that make it a worthy mention. Let's consider them individually:

1. Low interest rates:

I suppose somewhat of a counter narrative, but I believe low interest rates to be a positive when it comes to fintech investment. When considering the general flow of capital into the fintech ecosystem, low interest rates could mean less meaningful returns

for LPs or funding partners - giving the opportunity for VC/ PE to raise larger funds to deploy. Better written by Gompers and Lerner; “the willingness of investors to commit money to venture capital funds is dependent upon the expected rate of return from

these investments relative to the return they expect to receive from other investments”. This can be seen in the report I have linked to below, but the research suggests that a 1% interest rate increase leads to a reduction in VC fundraising by $647mn the

following year.

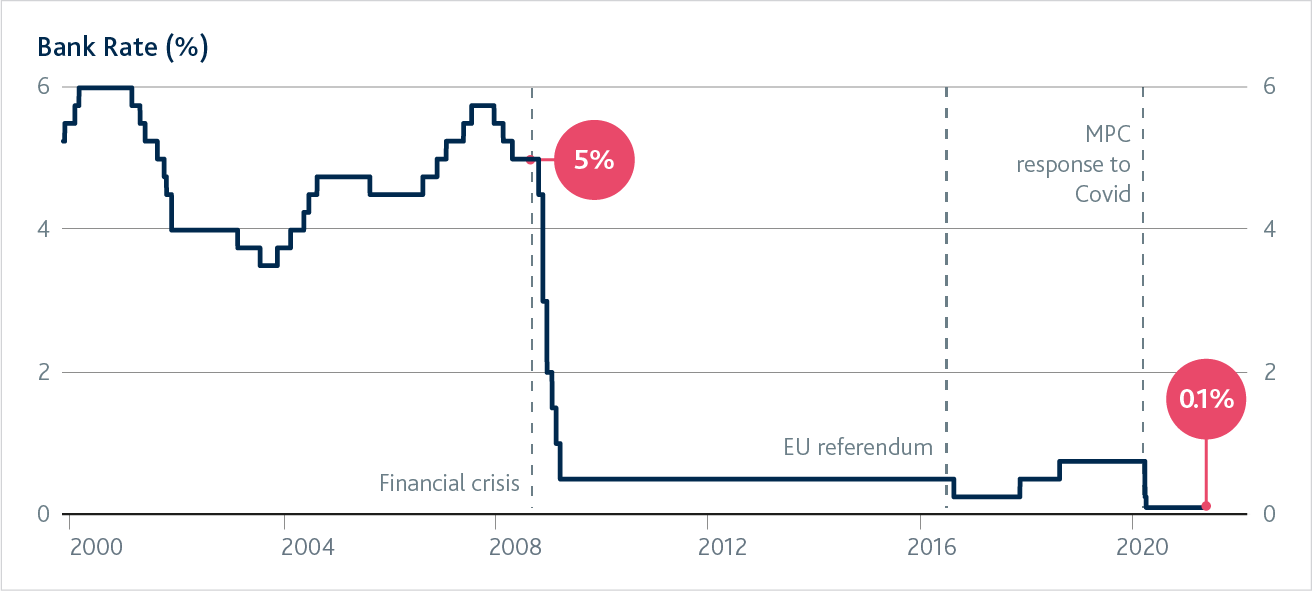

During the financial crisis we saw the Bank of England forced into a huge reduction in the Bank Rate in order to stimulate growth in the economy. As highlighted by the below, we have seen no real bounceback from that. In fact, only two trigger events have

seen any material alteration to this rate. 1. Brexit (let's leave that for now) and Covid.

(Source -

Bank of England Monetary Policy Report)

So whilst low interest rates are a stimulus for investment I believe the correlation here with both the birth of fintech (in my view circa 2008) and 2021 is a preceding strife of a much wider macroeconomic disturbance. Early Feb saw the first interest rate

increase in some time. Whilst marginal, if we defer back to that point around access to capital made earlier, (and much more succinctly in the paper highlighted

here) this could be a cause for reduced deployment of capital.

(If you have read this far, and want a bit more detail, please read the paper linked above - it is well worth your time)

2. Huge amounts of capital:

According to an Innovate Finance

article in the UK alone we saw over $11.6bn representing 217% YoY growth in the amount of capital available (see previous statement around low interest rates). But, of equal interest within the article is what stage of funding that capital is being allocated

to. 61% of global capital is being invested in later stage funding - this shows that people are taking less risks and are looking for existing product: market fit - and dare we even say it a pathway to profitability.

3. Volatile tech stock markets:

Whilst I think things are slightly different this time, investors are ready to back their businesses long term and the digital transformation that consumers are going through all over the world indicates that fintech is a great long-term bet. But we have

to be careful.

I think this does pave the way for M&A. How many warchests were built in 2021..? Let's think about it for a second:

●

NYDIG raised $1bn

●

Klarna raised another round $1bn

●

FTX raised a $1bn

I think you get the point but to put this into perspective. There were 457 unicorns created last year. 151 of these sits in the fintech space alone.

I predict that some of the biggest fintech players in the market are in a prime position to start acquiring a variety of hugely valuable businesses at a good market rate. Look at the tech stocks at the moment. It is certainly not making my eToro account

look very good at the moment.

And guess what, it has already started. We saw Plaid acquire Cognito this year already (here)

and our friends at FTX with their acquisition of

Liquid

Conclusion: how will this play out?

Everything that we see above makes for an interesting tale of caution when it comes to capital markets and the potential for a burst bubble. Yet every day we see more capital being allocated and more funds being created. Some, in the case of Sequoia, that

even now buck the trend of the 10-year cycle. For this reason, I think the conclusion is still to be written. I hope there is continued support of what has become my home and certainly an ecosystem that is doing so much good for this world. But I also hope

that valuations taper slightly and don't increase to a level of impossible return. We need these funds to return a profit to those institutions making investments, otherwise it is the pension fund and ultimately you or I that lose out in the long term.

Thanks for reading and hopefully this has at least sparked some thinking even if it is resolutely disagree!