Insurance is one of the industries actively introducing technology into its processes. In 2021, 59% of insurance firms

increased their investment in innovation to show customers new and better ways to deliver services, collect data, and detect fraud. Currently, blockchain technology constitutes a small but significant part of InsurTech's innovations. And it has already

proven itself a good solution to many of the industry's problems. Let’s consider three options for how blockchain affects insurance.

Is blockchain a silver bullet to solve the problems of the insurance industry?

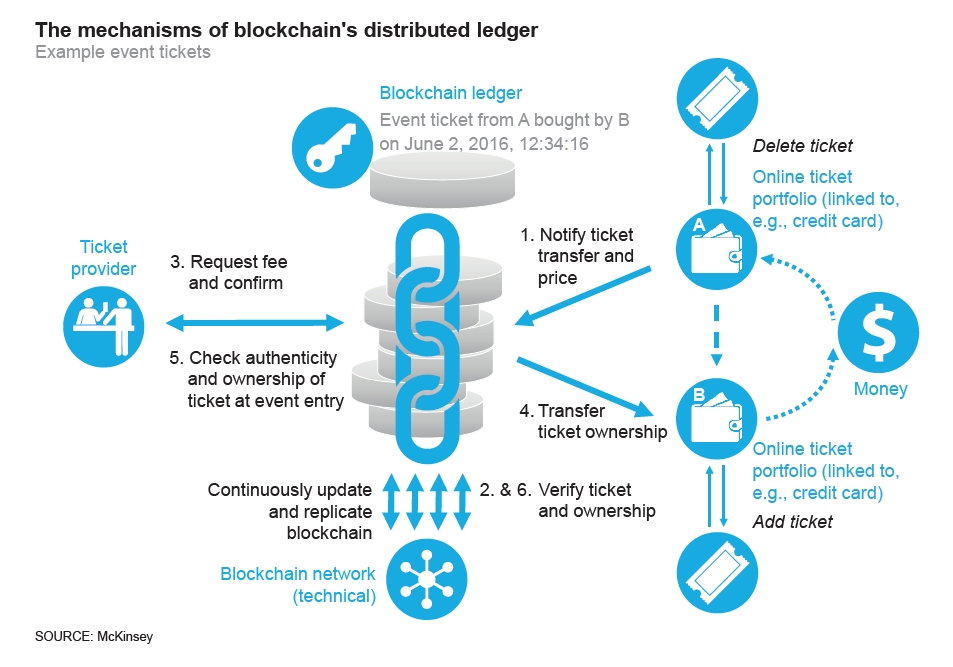

As a distributed ledger technology, blockchain has properties that are valuable for businesses. It reliably protects data, records only verified information, and monitors and stops illegal actions of network members. Blockchain can be trusted to store any

data (accounts, transactions, or medical records). Thus, you can conduct transactions with them promptly, honestly, and without intermediaries.

These blockchain attributes can be used to benefit insurance by improving the following operations:

The mechanism of blockchain operation in insurance can be described as follows. A client receives approval from an insurance company to issue a policy. Policy data is entered into a blockchain (the date and time of opening, the parties to the contract, and

the cost of individual contributions). The information is placed in a block, encrypted, and stored unchanged. Blockchain technology guarantees that none of the network participants can illegally change or compromise user data.

Claims processing and blockchain

Imagine the following situation. A person bought a first-class air ticket along with insurance. But they had to cancel the trip for important reasons, and it is necessary to return the money paid to the insurance company. How long does it take to get a refund?

About 7 days, no less.

As a rule, insurance companies process claims for weeks or even months. Consumers accustomed to fast service in commerce expect the same in other areas. But in insurance, the process is not so fast. A person needs to make a claim request by phone or through

a mobile app. After that, they will wait until the application is completed and processed, and then payments will be credited to their account.

Claims processing is gradually accelerating, bringing the industry closer to the “insurance on the go” paradigm. The industry is already offering short-term insurance options for travel abroad or taxi rides. Why can't insurance claims be processed at the

same pace so that funds are returned upon request?

With blockchain, it is possible to build a transparent and client-oriented model based on trust and security. Technology can provide direct communication between the applicant, the insurance agent, and third parties. All data is available for audit and insurance

payments occur instantly.

For example, Sompo Japan Insurance

uses blockchain for automatic train delay insurance payouts. If delays in railway transport are recorded within a month, the client will receive compensation.

Underwriting in blockchain

Underwriting in insurance involves the analysis and evaluation of various parameters: the reliability of a client, determining an insurance rate, the coordination of insurance conditions, and the formation of the insurance portfolio. The smallest details

are taken into account: from the client's income to an alarm or fire system in the house. After all, if you are wrong with the candidacy, the insurance company will suffer regular losses.

Blockchain can reduce potential risk and select more reasonable insurance rates for customers. For example, insurance companies can optimize the price by the number of paid policies for car theft in the same area. Smart contracts turn paper agreements into

programmable code that helps automate underwriting and claims processing.

AIG, Standard Chartered, and IBM

practice blockchain-based underwriting for multinational insurance. Coordinating the management of insurance policies across multiple countries is difficult. The team converted the policies into a smart contract that provides a real-time shared view of

policy data and documentation. In this way, insurance agents can easily track coverage and payments at the local and main levels, as well as automatically report payments to network members.

/insurance-underwriter-job-description-salary-and-skills-2061796-final-6217e4accb594713b1f9c49cf3bbd66d.png)

Blockchain for customer retention

The advantages of blockchain listed above (automation, high speed of claims processing, and low insurance fees) become the basis for attracting and retaining customers. This is what companies of all levels strive for in a competitive market, especially when

they plan to develop new applications and when ordering

BAAS.

With blockchain, insurers can improve loyalty programs. For example, bonus points for meeting certain conditions can be “transferred” to virtual loyalty platforms. There, users can exchange bonuses for gift cards and discounts or transfer points to loyalty

programs of other firms valuable to users. In this way, customers can exchange their airline points for store, restaurant, or cinema points. This approach provides freedom of choice and guarantees customer involvement.

For example,

Metromile uses blockchain to pay premiums to drivers who cover a certain number of miles at the end of the year. The company believes that in this way it will ensure fair insurance and consumer involvement. The firm is also considering converting payments

into digital currency.

Conclusion

Blockchain will help the insurance industry build business models that will solve industry challenges and help interact with customers most efficiently. The technology simplifies the procedure for approval of a candidate for an insurance policy, automates

the processing of claims and insurance payments, and increases customer retention. It helps the industry become mobile and advanced. Former CEO of AIG's commercial department, Mr. Rob Schimek said that blockchain can play an important role in the future of

insurance. His company is excited to offer innovations that matter to customers and to co-develop the key components of this new technology.