In the face of the worsened economic situation conditioned by the pandemic, many fintech companies now reconsider their processes. A particular focus is put towards more practical approaches in areas where the outbreak hit the most.

The first two actions every reasonable business owner should take are to elaborate the current crisis management plan or — if the plan doesn’t exist — develop it from scratch, and work on the business sustainability and even disaster recovery plans.

Source: KPMG

Currently, the pandemic leaves businesses in a situation of uncertainty. How may the current situation play out for your company? How to mitigate possible risks?

To help you find the right answers to these questions, further, we are discussing the most likely risks and methods to combat those. First, to the riks themselves.

Risks for Financial Enterprises

Declining Investments

We are starting to perceive what makes the economy “operate” as never before. Constant investment and consumption are the two driving forces that make this engine run, and due to the unpredictability, enterprises are more inclined to cut investments “until

further notice.”

Liquidity Reserves are Under Threat

Though the current situation may not impact the cash flows of many for the next few quarters, after all, it will inevitably come down to that. If the pandemic continues spreading, companies may grow out of cash and will be forced to address their liquidity

reserves.

Challenger Banks Lose Revenues

Benchmark interest rates close zero, and challenger banks will soon see their net interest getting lower. In turn, their funding expenses depend heavily on transaction revenues, so expect them to reduce disproportionally to lowering federal rates.

Challenges for Alternative Lending

Economic “depression” may affect banks’ loan balances with defaults, reduced loan amount, and other side effects. Lenders may end up dealing with soaring default rates and a lack of reserves.

For the first time, alternative lending and underwriting procedures may be tested severely, and those e-lending ”youngsters,” like Zopa and LendInvest, that planned to reach exit through IPO soon, will be forced to postpone their plans till better times.

Fee-based Schemes will Prevail

Another point of concern here is assets under management. Over time, robo assistants shifted from basic revenue models to fee-based assets under management (AUM). The latter will arguably be affected since market prices are approaching the bottom.

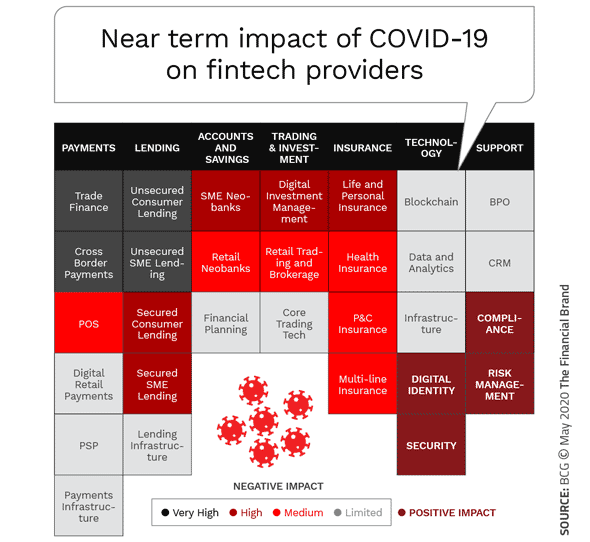

Source: The Financial Brand

Overcoming Uncertainty

Verify your Assets

First, consider your bottom line, including profits, cash flows, costs, and other assets. Also, all parties in your business environment — customers, business partners, and employers — worth keen attention, so invest more in partnerships, both existing and

new ones.

Force Majeure

Take another look at “force majeure” clauses in your product or service contracts; do they stipulate any guarantees in the economic situation like the current one? Also, review the wording for the subject of illnesses, viruses, or government actions under

force majeure. Remember that most contracts tell explicitly about the timing of notices, which is limited.

Ensuring Safety of Lending and Crediting

Speaking of loans, are the terms of your loan agreement still met under the circumstances? If the breach is likely, lenders can demand repayment. Thus, consider whether you can remedy it, or a lender should seek a waiver otherwise.

Again, check the default stipulations for the wording, mainly whether the pandemic can allow the lender to revoke the loan. Pay attention to clauses of material adverse changes scattered across separate provisions, including the covenant and default ones.

Is COVID-19 the cause of “material damage“ following the agreement?

Lastly, those are representations. Make sure you have the latest version of these since some documents require updating representations on an ongoing basis. In the light of the pandemic, you risk encountering the situation when that clause is no longer valid,

so be aware.

Check if your Insurance Policy is Solid

You can claim the insurance for business interruption if the damage occurred on the insured premises. Any of the “collateral damages,” like profit and client losses, are the sufficient ground to ask for insurance (even if they didn’t occur on insured premises).

Typically, property coverages that stipulate infectious disease cases are strictly limited in scope. Yet, those include cleanup and disposal of contaminated property.

Another crucial asset is Management Liability Policy. Given the rising number of D&O class suits accusing companies of malfeasance as causes of the downturn, get ready for adverse scenarios. Mind management obligations regarding employees

(FMLA, ADA, and others).

Since February, Travel Accident Policy doesn't include infectious diseases as causes for indemnification, yet that doesn’t affect individuals who contacted the virus. Thus, although businesses won’t be indemnified for disrupted or affected

business travels, their employees can still count on personal compensation. However, always discuss that policy and the potential risks involved with the risk management team before sending employees to business travels.

Bottom Line

No doubt, fintechs are going through unseen challenges. Only immediate practical measures can help in these hard times, and the sooner you start taking them, the more productive outcome you will get.