There are phenomenal companies that have achieved outstanding results in the banking and Fintech industry. Some of them are very well known, but most are not. What makes a digital banking superstar? Working with hundreds of financial professionals

worldwide, we have extracted 10 digital banking trends that characterize the approach of really successful financial businesses. All of them are closely connected to the ability to integrate user-centricity at all levels of the company.

#1 The banking monopoly is crushed forever: admit or quit

In the digital age, in which almost everyone is able to build an app, banks are losing their power over customers. The monopoly of banking is disrupted by global banking digitalization impacted by different banking regulations and the emergence of technology.

Even though it seems like simple math that products should work for customers, not against them, many banks still seem to make people’s lives extremely difficult. That's why, gradually, more and more people choose to leave the traditional banks with limited

options for the Fintech unicorns that offer convenience and positive emotions.

Recently, in some countries, large banks were almost monopolists because they had a very strong and stable market share. Strong barriers of the financial services market entry, loyal customers and the absence of worthwhile alternatives ensured good positions

for decades. Today they are processing digital transformation in a rush before it’s too late.

There's a joke that millennials would rather go to a dentist than a banking branch. Of course, it's an exaggeration, but it is based in fact. At the moment, consumers have a wide choice of convenient alternatives to traditional banking that solve user problems

and do that through pleasant, enjoyable and even fun experiences, while most of the banks are doing quite the opposite─causing stress, friction and frustration. Why would anyone put up with that if there is a possibility of managing finances simply and pleasantly?

This obviously takes power out of the banks’ hands.

#2 Bankers’ mindset of today affects their future

The future of the banking industry depends entirely on how the new generation of bankers can bring their mindset in line with the digital age. Some of them already use Design thinking to bring the best value to their customers, while others lag behind, with

a risk of missing the last train to success in the digital age.

There's a common problem in the financial industry─often numbers are more important than people. And, the future is owned by those who are able to empathize with user needs and expectations. Most importantly, what pains and struggles do they face and how

can that be solved? The so-called “digital banking superstars” put customers into the center of their business DNA─at every level of the company and in every employee and department.

F*ck the legacy

Traditional banks are focused on their culture of protecting their legacy and maintaining the corporate image. That's why any new changes come slowly and painfully. It is self-evident that this legacy is holding back a number of traditional banks. That's

the reason why even implementing new technologies doesn't save banks from losing clients. Banking superstars challenge legacies and encourage their teams to step out of the box.

Visionaries wanted

Steve Jobs, Jack Mae, Elon Musk, Jeff Bezos and Mark Zuckerberg are the heroes of the digital age. Surprisingly, however, they are not inventors of new technologies. They are brilliant visionaries who understand what people need before customers even realize

it themselves. Their vision executes such an innovative approach to available technologies that it has caused a cardinal disruption in the modern world. And, in the past few years, we’ve seen the rise of some Fintech visionaries. This is the “air” that industry

needs to evolve and grow.

Value is the mother of all

For many banks, the main focus is on the product and the benefits it will provide the bank itself in terms of increasing the profit. Banks are used to thinking about:

- How they will implement the technology;

- What features the product will have;

- What the team will consist of;

- What marketing tricks will help sell it, etc.

This kind of model has operated for decades, but banking superstars prove it's all wrong. The difference between thinking about product features and focusing on the user is value.

#3 Experience transformation displaces digital transformation

Everyone is aware that digital transformation is a must to survive and thrive in the digital age though not everybody knows that digitalization itself does not guarantee solid success in the future. There are so many cases in which attempts to transform

lead to failure.

You can use technology to create a mobile banking app for the customers, but that, in itself, doesn't make them happy. What if the app is difficult to understand and use? What if the users aren't able to do simple tasks without support? What if it's impossible

to reach Support, and the person on the other end is unfriendly and arrogant? We can all recall such situations.

We see so many examples of this on social media where people are sharing their awful experiences with digital financial products. Digital transformation itself is not enough to ensure customer happiness and demand. It's all about transforming the experience.

Digital transformation is pointless if it doesn't transform the user experience, and design is how we create this experience. We use UX design and digital technology to take an awful user-experience and transform it into an unforgettable one that makes users

happy and solves their problems.

The truth is, if you don't focus on the best possible experience for the customers, you will most probably lose them to the companies that have customer-centricity as their top priority.

Experience is the key in the digital age. We believe the future of the banking industry depends on the ability to deliver a delightful experience to the customers.

What is the purpose of any business digital transformation? To increase its effectiveness and success, right? And what determines its success; how is it measured? Someone may say it's about profitability, but where does the profit come from? Customers. Demand.

Loyalty. Recommendations. Satisfaction.

What does it all depend on in digital services? User experience.

This means that, if we want to increase success, we need to take user experience as a starting point and, based on this, select the optimal channels and service functionality.

Lack of this understanding becomes a constraining factor that prevents traditional players from carrying out a successful transformation. That's why, in fact, we should talk about experience transformation instead of digital transformation.

#4 Banks start to “look up to” Fintechs

What differentiates successful Fintech companies from traditional banks? It is the attitude toward their customers and businesses. The main aim is to help the customer, not to achieve profit in any way possible. It requires completely different business

priorities that are built around the user.

There is a huge difference between the Marketing Age, as we call it, the one before the digital transformation was in full speed, and the Digital Age or, as we call it, the Experience Age.

For some of us, it is really difficult to jump over it, but there is no other way to achieve future success. To fit into the new conditions, a business must integrate user-centricity at the level of mindset and culture.

To bypass the limitations set by legacy, more and more banks are collaborating with Fintechs, using the possibilities of open banking initiatives and integrating their solutions into the banking inner ecosystems. This way, Fintechs become the fresh blood

of the banking industry that paves the way to much-needed transformation.

#5 Vaccinate your team with user-centricity

UX, CX and Design thinking are in great demand by financial institutions because these are the key methodologies to create demanded digital products. Unfortunately, it's not enough to simply hire UX designers to ensure digital success in the highly competitive

digital environment.

In the digital age, only a business that's 100% focused on user needs can conquer the rising competition.

To achieve this 100% of the time, the best digital companies make sure every single team member puts the customers first and is obsessed with making their lives better. At the same time, there are many banks that believe it's enough, with one or two full-time

UX designers, to call themselves user-centered. Truth be told, in such cases, it wouldn’t be enough even with an entire UX department. UX is a way of thinking, not a tool. You can't build muscle in one leg and call yourself fit.

We see more and more banking executives who aren't afraid to roll up their sleeves, leave their comfortable penthouse offices and go to the field themselves. They meet customers at the front line (e.g., branches, contact centers, support lines) at least

one day in a quarter, actively use company products themselves, gain feedback from users about issues and participate in product redesign and improvement. They know that this kind of attitude is the best way to act in the digital age. And, this definitely

is worth it, as it pays off with admirable results.

Customers expect every product to live up to their expectations, but it's impossible to deliver such a result if everyone─from management to production─isn't involved in user-centered thinking.

#6 Upgrade design from ''package" to "language"

There's a huge misconception that design is about product packaging, nice-looking interfaces or marketing. In the digital age, design has become a key differentiator that separates demanded products from failures.

Financial UX design is not only a methodology you can use to create a successful product. It’s not about the tools we use, technology or innovation.

It's an ideology integrated at all levels of the company, in which the user is at the center of all business operations.

It defines the way you perceive the world, aiming to make it a better place for people to live. Without this, your provided solutions can’t become really valuable and demanded. That's because the digital revolution has changed the rules of the game we all

play. If you don't adapt, you will most likely lose.

Italian designer Massimo Vignelli has said, “Good design is a language.” A language to communicate to your customers, a language to understand their needs and expectations. A delightful design is the way to make your customers fall in love with your financial

interface.

Of course, UX, Design thinking, JTBD (Jobs-To-Be-Done) and HCD (human-centered design) are trending today. However, only a few financial product experts are capable of translating this into the user interface of a particular product because it requires knowledge

in human psychology and behavior. Perhaps this explains why, despite the recent increase in the number of digital financial products, most of the solutions around us are still not pleasant to use.

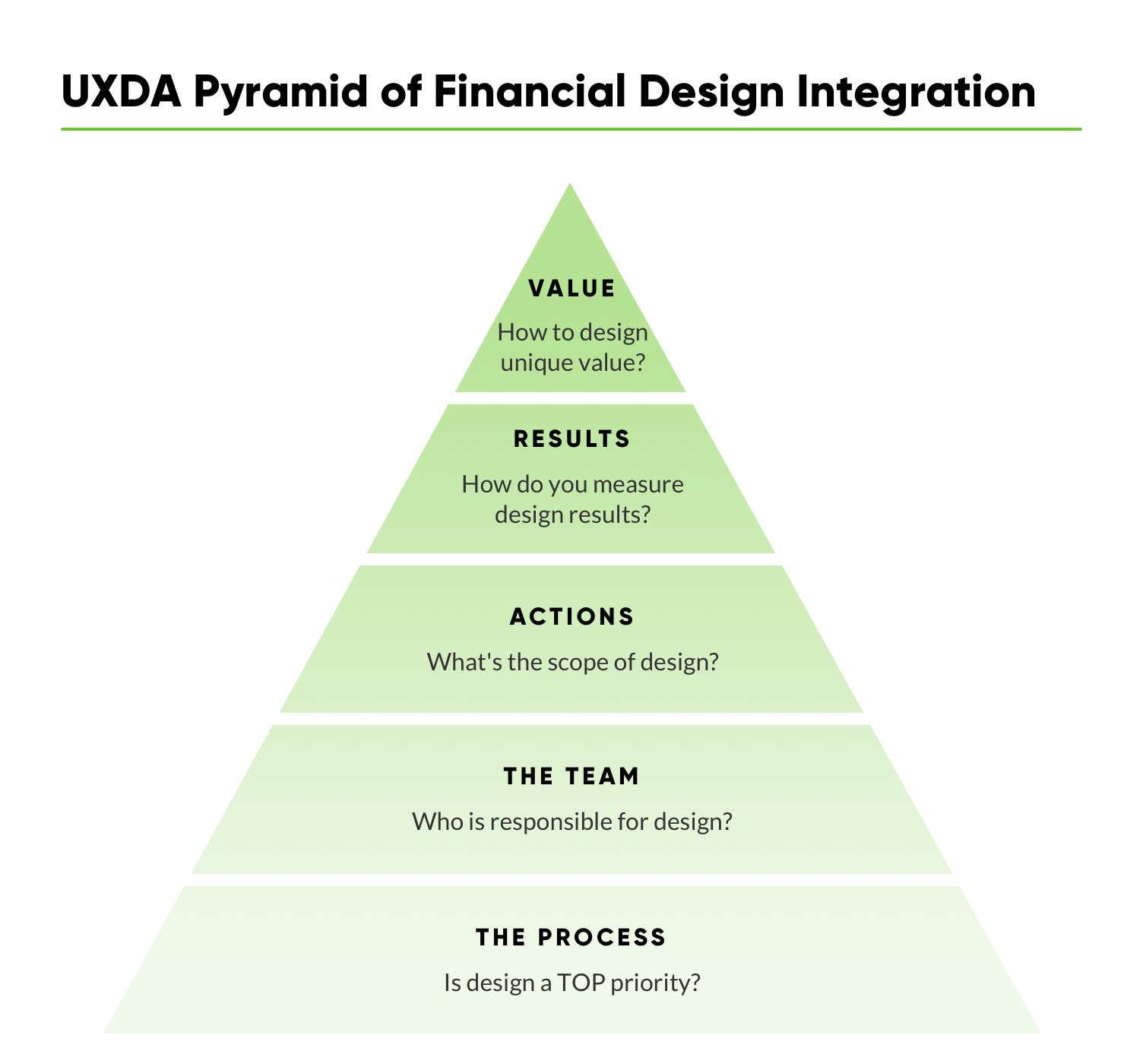

But, how do you get the most out of your product design? There are five possible areas in which the design process could be integrated into the product and company to ensure optimum results.

In general, these five areas match the main elements of business development. When you have a solid business idea, you need to create a business model by defining key Processes that will take you to the desired goal. In the next step, you need a Team of

specialists who are qualified to execute your idea. When you have found professionals who match the previously defined processes, you need them to conduct the right Actions that move you closer to product realization. To be sure you are moving in the right

direction, you have to evaluate the Results your team is producing. In the end, if all of the previous steps have been accomplished successfully, you can grasp the unique Value your product will provide to the customers, turning you into a success story.

#7 If the product sells itself, marketing becomes waste

We have all heard of products that have failed despite enormous marketing budgets and media attention. At the same time, we can all name several Fintechs that have created a client base of a few million users in only a few months. How is that possible?

The approach of delivering a useless product in pretty packaging and advertising it all over social media no longer works. The minute a person tries the product, and it doesn't deliver up to expectations that are partially created by the marketing campaigns,

everyone will learn about it if they decide to share this awful experience on social media.

And, then there's the other side of the story, how Fintechs and other successful companies use this situation to their benefit. They gather hundreds of thousands of users in a short time period with tiny marketing budgets, encouraging their customers to

share the pleasant experience and inviting their family and friends to try the service.

When it comes to experience and marketing in the digital age, you can reach almost anyone with no cost using social networks, but do you have something the consumer actually needs? Something that solves their actual problem and provides a delightful user

experience? These are important questions that financial institutions need to ask themselves because, if you don't have the right answers, there will always be someone who can and will─the next Klarna, Moven, Revolut or others.

#8 Excellent functionality is not your parachute anymore

Imagine that you have invented a product that provides functionality demanded by customers. All you would have to do is make it work properly and just enjoy your endless profit.

What if competitors copy the technology and start producing a similar product or service? Then you need to offer something unique that provides an advantage to your product and additional benefits to your customers.

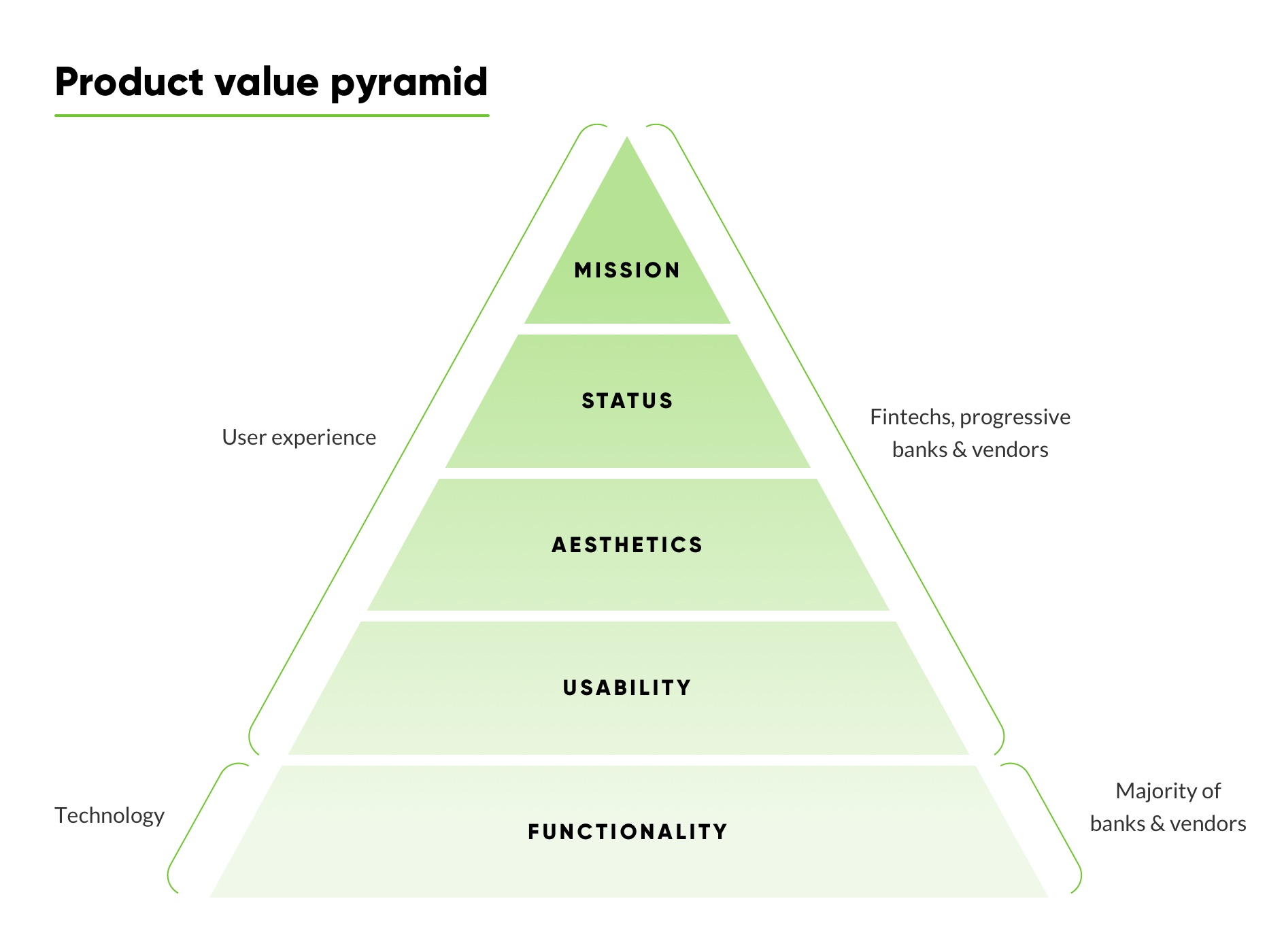

Banking superstars know that focus on functionality is no longer enough because everyone has it; you need to figure out the key benefit.

This is the moment when the competition requires you to step out of the box and identify customers’ expectations. If functionality is not enough to compete, provide usability. If all the competitors have the same functionality and usability, add aesthetics.

Or, if you need even more of an advantage, connect the product with the customer’s lifestyle by personalizing it; make it a symbol of his/her status. And, finally, you can go even further and state the mission to deliver the ultimate value that will change

the world and gain followers who look up to you.

The usual financial industry approach doesn’t match the disruptive requirements of the digital world. This creates a huge gap between failure and success. Such obstacles as lack of demand, inability to compete and lack of funding make every second project

fail in five years. It is crucial to understand and use the human-centered design outcomes to increase any project's chances for success. Provide an outstanding user experience to establish your service success in the digital age.

#9 Best financial products are developed reversely

The most demanded digital financial products are created using reverse engineering. We are not talking about stealing competitors’ technology by decomposing its constructs. We mean a top-down approach that begins with defining the ultimate value for the

user and ends with a development plan.

This is opposite to a common approach that starts with backend coding based on business requirements, then turns to further packaging in standard design and trying to convince users that they need it.

To maximize the benefit for the users, banking superstars start with UX research to discover and define the most effective way to deliver product value to the customers, while design helps to materialize it into the look and feel of an actual product. They

spend a lot of time and money on searching for the best product architecture, before starting the actual coding. Why? Because this is how to reduce the risk of failing caused by creating unusable, complex financial products that lead to millions in losses.

There's a saying... if you wish to predict the future, create it, and that's basically what design-based companies do. They maximize the product's success by making sure users will get the ultimate value out of the product. This is a guaranteed way to create

an experience that users will love and will be eager to recommend to their friends.

I like to compare reverse engineering to a maze that has multiple entrances and only one exit. The entrances are different types of product configuration, functionality and features. And the exit is the high demand and success on the market. Usually, the

entrepreneur tries to guess which configuration he/she should develop. They look around to figure out what products are trending, code a lot of features to impress customers and finally pack all this into a vibrant design to grab attention. Then they spend

tons of money on advertising to convince consumers that they need this. Unfortunately, this is a very expensive Russian roulette.

In reverse engineering, you significantly reduce uncertainty by starting from the maze exit and moving to the correct entry. In this case, the exit of the maze is the point at which the product is highly demanded because of the value it provides to customers.

By beginning with exploring the value that's significant to customers, we put the focus of the product and the entire business on the needs of customers.

This is not easy and very often requires a dramatic change in the company’s decision-making principles, inner cultural values and the logic of business processes. But, this pays off with growing demand and user satisfaction.

#10 Watch out for the Tech Giants

We are witnessing active financial solution integration into tech giants’ ecosystems─credit card by Apple, debit accounts by Google, micro transactions inside Messenger, cryptocoin and Libra in association with Facebook.

Despite that, most financial companies don’t take their appearance into account. They argue that those could not even compare to fully functional traditional banking solutions. So, why worry, right?

I believe Nokia had similar thoughts when they saw the first iPhone. They probably figured this was just some new kind of touchscreen smartphone model for a small, specific audience. It looked like nothing to worry about because Nokia produced billions of

phones in dozens of models for different audiences.

Today, there are hundreds of touchscreen smartphones on the market, and only a few old-fashioned models for a small, specific audience.

Since, most of the time, I use Messenger to chat with colleagues, family and friends, it's great to send them money on the go. It's definitely more convenient than close the chat and then launch a banking app. In my case, this extra click elimination makes

me prefer Messenger payments instead of local banking. How could this impact banking transactions if used by billions of Facebook users?

It's crucial to carefully evaluate the impact of such tech giants’ banking products on millions of users. Exploring it from a user perspective is a clever way to detect disruption before it is too late. At the end of the day, it could provide insights on

how you should rearrange the user experience of your product to prosper in this fast-paced digital world.

OK, but what now?

To start 2020 with a plan, not a regret about mistakes made in the past, we offer a 6-step action plan to set user-centricity in action.

1. UX instead of budget and tech

Being successful in the digital age does not depend on the size of the budget, the scope of the team or technology you use but on the ability to focus 100% on the customer. Drop your ego and step into the customer’s shoes. Don't rely on the success of today

because the digital experience is constantly changing. Have courage, think outside of the box and save the industry by disrupting it.

2. UX as a mindset, not a trick

The way to a successful business is not about magical promotional tricks. It is about designing an awesome customer experience that will make your product a market leader.

It's important to be aware that Design Thinking and UX design are not marketing tools; it is a new mindset, and it should be implemented at every company level, from strategy to operations, in order to succeed in the digital age.

3. UX is about care for the users

It's inexhaustible curiosity to find the best way to meet user needs and business goals. Without this, you will see thousands of boring and similar products because their creators lack curiosity and passion to make a difference.

4. UX = empathy

Empathy requires us to put aside our ego in order to understand other peoples’ needs and pains. It requires a strong skill set and a specific approach to step into another person’s shoes. For this, we have to abandon our habitual ideas and biases. This helps

to design products adapted to users’ needs.

5. UX brings love to your product

The thinking of “one size fits all” is long gone. Personalized solutions create emotions. And, emotions drive the value of your product, resulting in conversion. Don't let complex information lead your business to failure and destroy the customer experience.

Add emotions that make users fall in love with your product. Often, the financial industry is afraid of emotions. But, the truth is, emotions make users attracted and loyal to your product.

6. UX is a never-ending process

UX is an ongoing process that consists of looking for improvements that could be made for the customers. It's not enough to do it once and forget about it forever. It's a daily routine, based on user-centered mindset. A company that's not ready to adapt

and constantly improve their UX, is useless and unable to survive. UX is a lifestyle you have to integrate and live by in order to make the business and product a success.

Ahoy, towards a better future

Changes in the market are happening at the speed of light. The financial market is disrupted by Fintech technologies, Open Banking, AI, blockchain, etc. The question is, will you make it to the last train that separates losers from winners in the digital

age?