I was intrigued by the production of the below graphic after being asked to comment on it by colleagues within the context of Open Banking. Without question, it gives food for thought.

With the luxury of hindsight, it feels odd that it took almost half a decade for electricity to be available to a mere 25% of the US population. There are very good reasons for this, of course, not least the building of necessary infrastructure and laying

of cables.

At the other end of the spectrum, smartphones took only around five years to achieve mass market adoption.

What is the difference? I think there are several underlying factors at play here, and all are applicable in the discussion on Open Banking adoption. The first is that there is a huge variance in the amount of friction in the purchasing of a smartphone,

versus having electricity installed in one’s house (or even indeed, town or city.) The second is that it took many years for electricity to be demonstrated as both safe to use, and with real-world value. The convenience afforded by new mobile phones is obvious

to anyone - the ability to call and text, the abundance of mobile apps, keeping in touch with networks on the same platforms, and more.

Here I will illustrate that Open Banking is on the cusp of mass market adoption in a very short timescale. I will illustrate this through evidencing:

- How Open Banking removes friction within the financial sector for both consumers and lenders

- How Open Banking is a key strategy for regulators and governments across the globe

- The sustained growth in Open Banking usage, shown through API call growth

- How market conditions are ripe for Open Banking

- Networks are already in place, allowing for immediate use

- How banks and others now see the value and are pushing for the use of Open Banking

Image via

https://marketrealist.com/2015/12/adoption-rates-dizzying-heights/

Over the last century, we have seen new technologies being adopted faster and with far less friction. As I'll go on to discuss, there are several aspects to this. One I will cover that I have not seen discussed elsewhere is in the twenty-first century, there

is little humankind does not think achievable. Take some examples:

- Technology that can help reduce or stop global warming (carbon capture and storage, batteries)

- The rise of entrepreneurs such as Elon Musk who are quite literally shooting for the moon (and Mars)

- Biotech advancements such as stem cell research and the Human Genome Project

- Greater understanding into our planet and the universe through disciplines such as quantum mechanics

My understanding is this differs significantly from theories on technological advancement from the turn of the last century. Quotes abound the internet of company executives ridiculing new technologies, only to be left with egg on their face. The car, telephone,

plane and others all have derisory quotes attributed to them.

Of course, not all technology was brought to bear with the same force or underwent the same challenges before accepting mass market approval. Electricity and the telephone – due to the time taken to build infrastructure - took longer to gain mass adoption

than others from the same era, such as aircraft.

It would indeed be a brave man that decided now to publicly speak out against any new technology before it had been tested in the market.

We now know the harnessing of electricity and the potential benefits it provides would take many decades before a significant volume of the population had access to it. In contrast, between the date of the Wright brothers maiden flight in North Carolina

in 1903, it was only a small jump to the first powered flight across the English Channel (1909) and the mass use of aircraft during the First World War.

So why is new technology adopted so much faster now?

As I alluded to above, one of the key reasons is the unbridled belief that today, nothing is off the table. Whether it be cures for cancer, saving our planet from the ills of climate change or sending humans to new territories in the galaxy, entrepreneurs

are receiving the funding and backing they require to make dreams become reality.

The removal of friction is also important. In the past, there was a need for networks to be built in order for a technology to “break out”. I’m thinking here of tracks for trains, wires and undersea cables for electricity, modems and broadband for the internet.

As

Visual Capitalist discuss in their article:

“Massive amounts of infrastructure had to be built and network effects also needed to accumulate to make the product worthwhile for consumers. Further, the telephone suffered from the “last-mile problem”, in which the logistics get tougher and more expensive

as end-users get hooked up to a network. As a result, it wasn’t until the 1960s that 80% of U.S. households had landlines in them.”

And the internet itself has been paramount. Knowledge and ideas can be shared with millions of people across the globe at the touch of a button. Networks of scientists, entrepreneurs, explorers or technologists can be brought together into communities regardless

of geographic location. Virtually the collective knowledge of the human race has been published online for anyone to read. The internet has enabled all of this.

The key is for new technology is to be so convenient, that it is more difficult to opt out of.

I have taken careful note of the Chinese experience where the proliferation of service providers such as Alipay and WeChat has meant everyone routinely pays with QR codes on their phone – it has literally become too convenient for Chinese consumers to consider

anything else. As an aside, it is also interesting to note

Barclays has signed an agreement to allow Alipay payments at UK merchants, allowing Chinese consumers added convenience on UK shores.

Image via

https://www.vox.com/2018/5/30/17385116/mary-meeker-slides-internet-trends-code-conference-2018

Applications in an Open Banking World

The use of bank data is not an entirely new concept. Banks themselves have been using their own data for customer segmentation and promotion for decades. The real change comes in how it can be applied by the consumer for their benefit.

Let us begin with the growth of API calls made through Open Banking in the UK (all figures courtesy of the OBIE).

The growth in volume of API calls has grown from around 2m in June 2018, to over 35m in March of this year. If we carry on with this trajectory, we could top 50m by year end. This figure calls for celebration and is a clear cue to the success Open Banking

has been in the UK.

The volume of API calls is a direct indicator of how many individuals are currently using Open Banking services and can provide an indicator of how close we are to mass adoption.

Regulations

The UK was the first jurisdiction on the planet to implement a mandated Open Banking regulatory system. As well as Open Banking being mandated by the Competition & Markets Authority (CMA), the regulatory groundwork and market conditions in the UK made it

a perfect place to start.

Historically, most technological advancements have not required regulator intervention to succeed. In the case of Open Banking however, what is required is the data held by banks. It was clear to anyone in the market prior to 2018 that the banks would not

hand over this data without being mandated to do so. Having now done so, the banks are recognising the benefits Open Banking can bring.

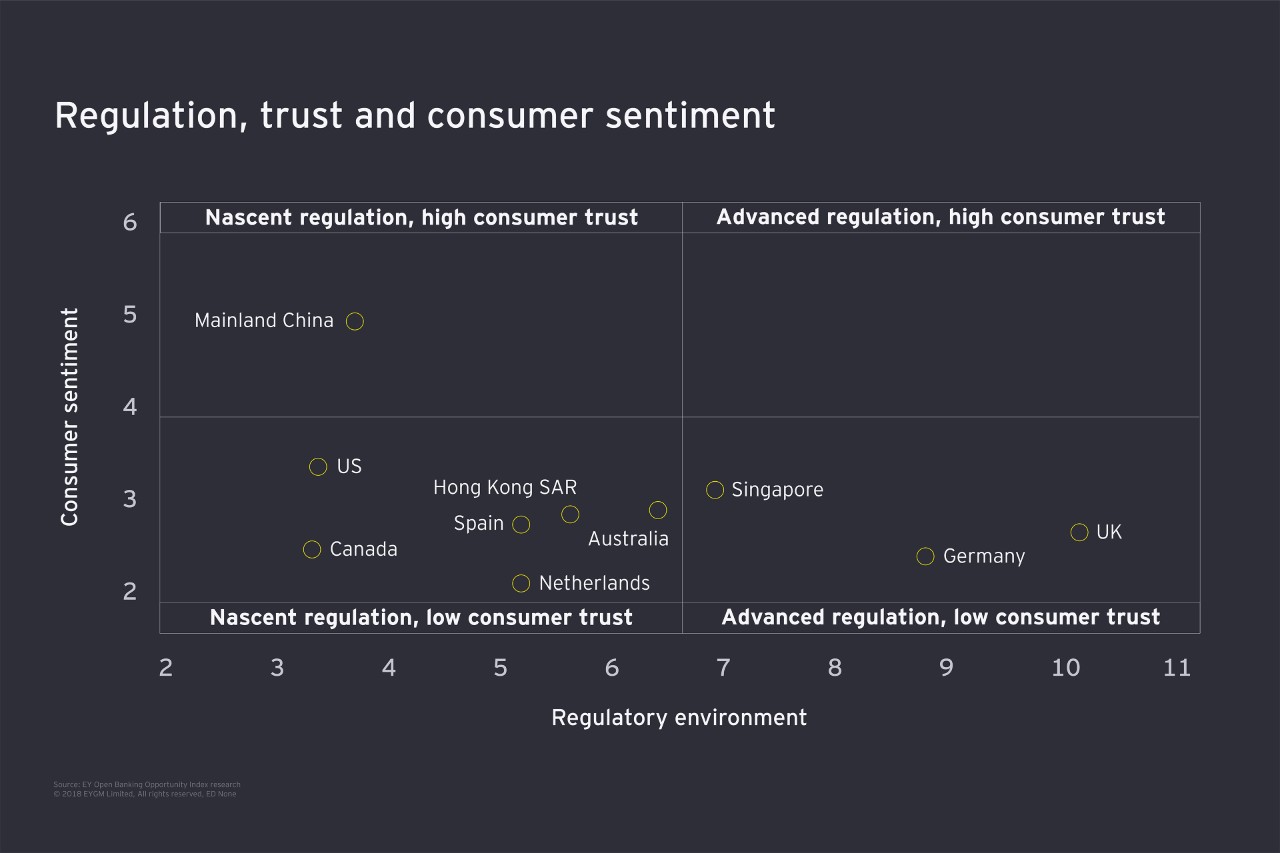

Image via

https://www.ey.com/en_gl/banking-capital-markets/ey-open-banking-opportunity-index-where-open-banking-is-set-to-thrive

The above table is from

EY’s Open Banking Opportunity Index, which illustrates that regulations have taken us a considerable distance, and what is now required to make a success of Open Banking is for consumers to trust the technology in place.

Regulators can play their part, but it is only when consumers trust their data is safe, that Open Banking will truly succeed. This will be determined by illustrating to consumers the payoff between sharing of their data, and convenience and cost savings.

As shown by the example of social media, consumers will share information if they perceive the benefit. This was illustrated in new research from CREALOGIX which states that

68% consumers are interested in the benefits borne through Open Banking.

Banking Perspectives

The move towards Open Banking and the use of bank data has been characterised as one of legacy banks failing to adapt to the new world, while Challenger banks invest in Open architecture and infrastructure. This characterisation is valid only up to a very

limited point. There are many incumbent banks who completely see the value in the use of bank data and are reaping the rewards for doing so. At the same time, the digital banks have done a fabulous job of building a marketplace of apps within the confines

of their own applications. Starling, Monzo, Revolut and others have been afforded this opportunity as they are unhindered by legacy technology that has allowed them to build their architecture on open API platforms.

The big banks are now sensing the opportunity for them to profit from Open Banking is there and that it can be used across a number of service areas, from compliance and KYC, to customer onboarding and credit checking and reporting.

Even at a very basic level, the big banks have almost in their entirety, embraced Open Banking to the point of offering account aggregation. While this remains very much the ‘jumping off point’ for Open Banking, it does reflect there is a will to make it

work and see commercial value from it. I look forward to further news on the introduction of commercial APIs, due to be available this year also.

With Open Banking being adopted by virtually the full gamut of British banks, both Challenger and legacy, it allows the whole population for the UK to begin embracing the concept. I know I will not be the only one who sees reference to it every time I open

a mobile banking app. This removes friction within the adoption process and see more people use the services, faster.

PSD2

In September of this year, the Second Payment Services Directive (PSD2) will go live throughout Europe. Closely linked to Open Banking, it will see millions of people across Europe introduced to its benefits. With bank data being utilised across borders,

the introduction of PSD2 and the publicity it will generate will further reinforce to UK consumers the technology is here to be exploited.

But why stop at Europe?

Beyond Europe, we are witnessing the proliferation of Open Banking across the globe. Suffice it to say every continent and geography is now well on the way to implementing Open Banking – most based on the UK experience. As trust in the system and the underlying

technology progresses across Europe and the globe, I expect to see demand from consumers for even more services related to Open Banking.

Priorities

The rise of Open Banking in different jurisdictions has however meant the look and feel of Open Banking can and will be very different. As an example, it is only in the UK that it is mandated. If we look at the Australian example, they have tied Open Banking

to Consumer Data Rights (CDR) that covers more than current accounts but also areas such as utilities. In the UK there has been a focus on current accounts in the first instance, while Europe will immediately cover other financial products such as credit cards.

What we have therefore is banks and FinTech’s in different parts of the globe all working on their own priorities. While I don’t necessarily believe this will hinder the adoption of Open Banking, it may give it a different look and feel in different parts

of the world. Furthermore, while we have talked incessantly about one “Master App” that can rule all over all others and dominate the market, the competing priorities dependent on local legislation make this unlikely.

Wrap

The world is a very different place to the early 20th century where we commenced this article. Technology, attitudes to it, and the world in which we live, have all grown out of all recognition from 100 years ago.

What we have witnessed from some of the very earliest modern technology is there was a long adoption period as infrastructure and networks were put in place around them.

What we have in 2019 is an inter-connected world, in which the internet and linked technologies have diminished all borders and ensured that nearly every person on the planet has the same tools with which to innovate and discover.

While it can be difficult to draw direct corollaries between early tech and the introduction of Open Banking, there are lessons on which we can draw. The end result will be the wholesale adoption of Open Banking in a very short space of time – best measured

in months rather than years.

The most important of these to me, is Open Banking removes friction from both consumers and financial institutions. In a similar vein, when the tradeoff between giving access to data and the savings in time and money that can be made is made evident to consumers,

adoption rates will further increase.

I believe that when we look at the advent of Open Banking, the story that I referenced above of Barclays signing a partnership agreement with Alipay will also prove to be a marker. Here we have one of the UK’s biggest banks offering Alipay through its merchants,

in order to remove friction and make it easier for visitors to the UK to spend money.

The fact that Open Banking has already been well received in the UK, and is making great strides in many other parts of the world will also see consumers hurry their governments and regulators for action where it has not yet been introduced.