There was one particular subject that got the spotlight at the recent fintech conference that I talked about. India stack.

Meaning, the number of government-led initiatives to bring India to the front seat of the world digital economy. That is one lucky 1.2 billion population country.

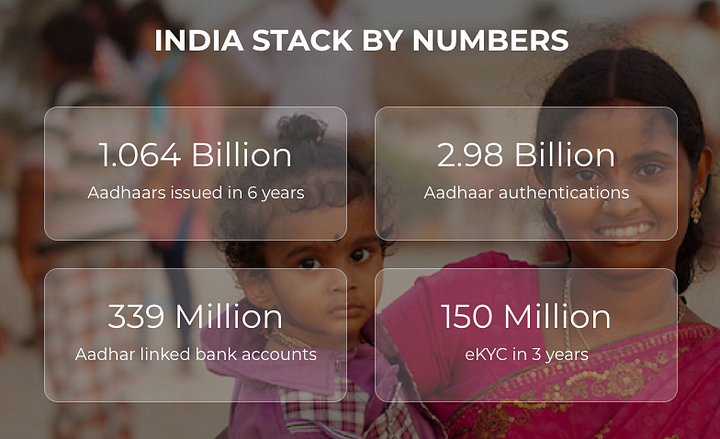

Aadhaar serves as a founding block of the digital economy. Aadhaar is an identity authentication system that contains the name, address, date of birth,

gender, photo, and biometric data — fingerprints and/or iris scan about each citizen. Every citizen can get their Aadhaar number, and before September 2018 every business, online or offline, could use the Aadhaar for the user authentication purpose, known

as eKYC process. That was especially valuable to online loan providers.

Indiastack.org

Indiastack.org

Another feature of Aadhaar is the possibility for the eSign signature, opening horizons for the digital way of life. eSign as the name suggests allows to sign documents electronically, and regardless which device is used, as long as the

citizen is authenticated with Aadhaar. The documents themselves can be stored, uploaded and transferred to DigiLocker — dedicated cloud-hosted platform for document issuance and certification. Instead of having important documents like driving

license or school certificate only in paper, both citizens and government agencies can manage them electronically.

Adhaar card sample

Like that’s not enough, Aadhaar holders have their personal data safeguarded from overuse or malicious use by DEPA (data empowerment and protection architecture). Much like GDPR, it focuses on the precious clarity about what data is taken,

how it is going to be used, and with whom shared, conscious consent is the key.

And then there is a UPI. Unified Payment Interface.

Applicable only for bank account holders, it allows the Aadhaar identified citizens

to bind their bank account(s) to Aadhaar, and then send money transfer to other people, or pay for stuff or services without the need to enter bank account information, or log into. At least it is technically possibly, and was perfectly in

use until recently.

PayTM blog

UPI is actually an API for the participating

banks and payment providers, where they can pull and push information about money transfer or payment, not restricted to their own knowledge of the citizen’s bank account.

In fact, any payment-focused mobile app or website, be that specific banking app or e-wallet can integrate this UPI to retrieve citizen full banking information that is stored with Adhaar and accessed by virtual payment ID.

UPD: However, this September 2018 Supreme Court of India disallowed the use of Aadhaar-based eKYC for the private firms, meaning all fintech. At the time of publishing this article, private firms has appealed

for the change in this rule, and the whole sector awaits on clear guidelines for KYC procedures without Aadhaar. The fintech industry in India is described as

‘deep in frustration’.

PhonePe website

Before this sad event fintech was happy about not needing closed systems. UPI enables online and offline, p2p, c2b, b2b payments, supports in-app purchases, deep-link, one-click payments, bill sharing, barcodes, utility payments… you name

it. Money transfer between banks are immediate, no Visa or MasterCard involved.

From the citizen perspective it was extremely easy, safe and convenient payment scenario, no matter which bank, or e-wallet, or online loan provider they used. Payment companies could afford to focus on the product, and not infrastructure.

Google Pay for India website

Meanwhile, the government has their own payment app — BHIM to promote new way of digital payments and push for acceptance. But the rapid

growth was actually facilitated by the private companies — Alibaba-backed PayTM, Flipkart-backed PhonePe, and Google

Pay (ex-TEZ).

What is going to happen next? Will the Supreme Court edit its ruling? Progress or regress? eKYC or paper-based KYC? Where the digital payment evolution is taking India and their 128 banks and payment providers supporting UPI that generated

close to 10.5 billion USD, jumping 10 times the amount just a year ago?

Let’s see.

The blog post was updated on November, 28th due to highly relevant comments on changes of legislation earlier this year (UPD mark).

***

Anna Kuzmina is the deputy Chief Commercial Officer at Yandex.Money, one of the leading fintech companies of Russian origin, operating both b2c and b2b financial

services. Follow Anna on Youtube, Twitter, Medium, Telegram or Яндекс.Дзене.