from Alizila

from Alizila

Nordics are awesome in so many ways. And one of those is my favorite fintech.

We are already used to Alipay daily appearing in the news when they make yet another partnership in yet another country popular among Chinese tourists. So when the news

about Bergen appeared, I was not impressed.

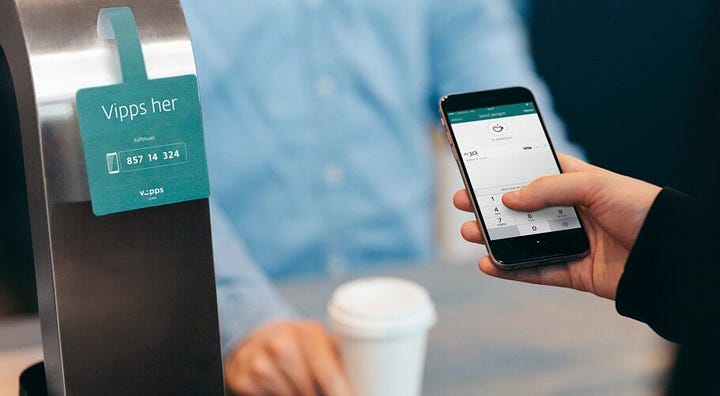

Not until I talked with Norwegian payment app Vipps and learned about their experience. So what they have done is very simple — money transfer to people by the phone number. Plain simple as that. No blockchain or AI, and yet this has won

over the nation in no time.

This mundane thing as money transfer or sharing a bill was done in cash before, as the banking applications were not as straightforward and usually required a knowledge of somebody’s bank account number. Nobody wants to deal with the difficult number series

(including card number), and would prefer a well-remembered phone number or the name in the address book instead.

from Spareskillingsbanken

from Spareskillingsbanken

This is exactly what the largest Norwegian bank DNB recognised when looking at the neighbouring Denmark example — a very

aggressive and ambitious MobilePay set by Danske bank, or Swedish Swish.

For not being overcome by the Danish, Norwegian banks created Vipps, and became its owners.

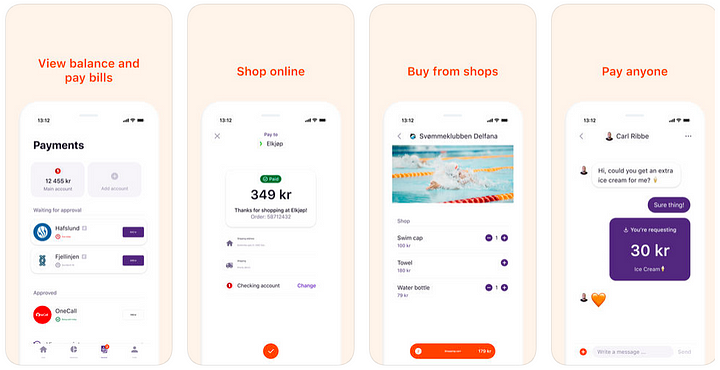

Vipps is a part of Norwegian daily life, it is used to send money, tip, gift, purchase items, pay for services, even your own taxes and bills. The name itself became a verb, like ‘vipps me 10 kroner’. I think that’s the main mark for the

success.

from Vipps app description in Apple App Store

from Vipps app description in Apple App Store

More than that, Vipps merged with two other very important companies in Norway, effectively, covering all possible sides of fintech development.

from SecureIDNews

from SecureIDNews

BankID is an authentication system, e-signature and digital identity for the banks and local businesses (now 4 million of them). Digital identity is

actually one of the most prominent areas where Norway sees its development further, just as India does as well.

from Enterprise Innovation

And BankAxept — local card scheme that takes around 86% of the market, leaving Visa and MasterCard far behind. It is also the reason why Apple Pay were not

as successful in Norway, only able to get support from the international banks operating in the country, and not local leaders. What is the point for the banks to pay fees to Visa and MasterCard, and to Apple, when your own card scheme is dominant and

extremely cheap — only €0,03 per transaction?

So this conglomerate — Vipps + BankID + BankAxept — controls payments between people, individuals and businesses, and between businesses. Local card scheme ensures low cost, and BankID — digital infrastructure for the businesses makes the

control over transactions easy and transparent. All of these systems are owned by banks. Altogether. In peace.

Bravo, Vipps, bravo, Norwegian banks.

from China Plus

Oh yes, Alipay in Norway. So Vipps also works on a

in-built QR-code technology in addition to its usual payment scenario. Instead of boring tech integration with Alipay, like other payment providers around the world do — Vipps stepped over imaginary limits.

They created interoperability with Alipay QR-code format. Essentially making

it possible for Alipay users scan Vipps QR-codes, and vice versa — Vipps users to scan Alipay’s. So it seems it’s not only Alipay’s achievement for its IPO boost efforts. Not only great convenience for the Chinese tourists.

That’s also easier rails for Vipps to soon comfort its Norwegian population during their travel around the world.

Once again, bravo, Vipps!

***

Anna Kuzmina is the deputy Chief Commercial Officer at Yandex.Money, one of the leading fintech companies of Russian origin, operating both b2c and b2b financial

services. Follow Anna on Youtube, Twitter, Medium, Telegram или Яндекс.Дзене.